So it comes down to this. Republicans believe they can turn bullshit into gold. Despite the inescapable conclusion of history, theory and empirical evidence to the contrary, Mitch McConnell, Jon Kyl, John Boehner, Tom Coburn, John McCain, Kay Bailey Hutchison and other Republican alchemists continue to insist that cutting taxes increases government revenue and thereby reduces the deficit. Of course, even though the tax cut claim is laughably false, conservative ideology requires that it must true. Otherwise, the Republicans have just been giving money to rich people.

To be sure, the high priests of the Republican Party have been singing from same hymnal. House Minority Leader John Boehner reintroduced this immaculate deception last month, wrongly protesting that the Bush tax cuts did not contribute to the torrent of red ink swamping the Treasury:

"It's not the marginal tax rates ... that's not what led to the budget deficit. The revenue problem we have today is a result of what happened in the economic collapse some 18 months ago."

"We've seen over the last 30 years that lower marginal tax rates have led to a growing economy, more employment and more people paying taxes."

On Sunday, Jon Kyl (R-AZ) the second ranking Senate Republican made the same point another way, telling Chris Wallace of Fox News, "You should never have to offset cost of a deliberate decision to reduce tax rates on Americans." Aborted Obama Commerce nominee Judd Gregg (R-NH) soon chimed in, declaring "I tend to think that tax cuts should not have to be offset." For his part, Oklahoma's Tom Coburn argued his math will work in the future if you ignore the past, "Continuing the [Bush] tax cuts isn't a cost, if you added new taxes, new tax cuts, I would agree that's a cost." And on Wednesday, Senate Minority Leader Mitch McConnell explained how tax cuts magically turn red ink black:

"There's no evidence whatsoever that the Bush tax cuts actually diminished revenue. They increased revenue because of the vibrancy of these tax cuts in the economy. So I think what Senator Kyl was expressing was the view of virtually every Republican on that subject."

Which is sadly right. Arthur Laffer's supply-side snake oil has been Republican orthodoxy ever since Jude Wanniski sketched Laffer's curve on a cocktail napkin.

In February 2009, Texas Senator Kay Bailey Hutchison offered the purest expression of the tried and untrue Republican gambit:

"I think we get revenue the way we've done it in the past that has been so successful in the past and that is tax cuts...Every major tax cut we've had in history has created more revenue."

As his 2008 presidential election neared, John McCain, too, experienced a just-in-time supply-side conversion. In 2001, McCain had opposed the $1.4 trillion Bush tax cuts because, "I cannot in good conscience support a tax cut in which so many of the benefits go to the most fortunate among us at the expense of middle-class Americans who need tax relief." But with the Republican primaries approaching, McCain renounced his heresy: In 2006, he added Laffer to his economic team and by 2007, proclaimed his support for making the Bush tax cut windfall for the wealthy permanent:

"Tax cuts, starting with Kennedy, as we all know, increase revenues."

Of course, just because Republicans claim it, doesn't make it so.

Ezra Klein was quick to sum up the "evidence" Mitch McConnell pretended was non-existent:

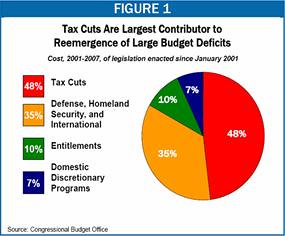

But how about the Congressional Budget Office's estimations? "The new CBO data show that changes in law enacted since January 2001 increased the deficit by $539 billion in 2005. In the absence of such legislation, the nation would have a surplus this year. Tax cuts account for almost half -- 48 percent -- of this $539 billion in increased costs." How about the Committee for a Responsible Federal Budget? Their budget calculator shows that the tax cuts will cost $3.28 trillion between 2011 and 2018. How about George W. Bush's CEA chair, Greg Mankiw, who used the term "charlatans and cranks" for people who believed that "broad-based income tax cuts would have such large supply-side effects that the tax cuts would raise tax revenue." He continued: "I did not find such a claim credible, based on the available evidence. I never have, and I still don't."

The Center on Budget and Policy Priorities demolished the mythology promoted by President Bush ("You cut taxes and the tax revenues increase"), Judd Gregg ("these tax cuts pay for themselves") and the usual suspects on the right. If the fact that the national debt tripled under Ronald Reagan and doubled again under George W. Bush wasn't proof enough, CBPP found that Bush tax cuts accounted for almost half of the mushrooming deficits during his tenure:

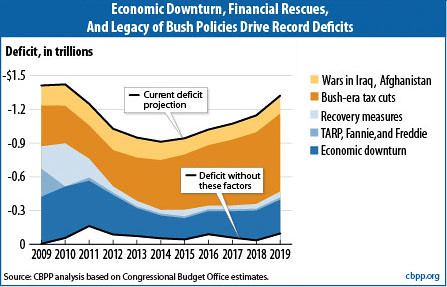

And as another recent CBPP analysis revealed, over the next 10 years, the Bush tax cuts if made permanent will contribute more to the U.S. budget deficit than the Obama stimulus, the TARP program, the wars in Afghanistan and Iraq, and revenue lost to the recession - combined.

As Ezra Klein and Matthew Yglesias suggested, Republicans ultimately don't care about the deficit. And as both Klein and Yglesias concluded last month, the CBO's latest forecast makes clear that the very worst thing Congress could do to trim the deficit is make the expiring Bush tax cuts permanent.

But for Republicans, tax cuts trump all else. As Dick Cheney himself suggested in 2002 when he announced, "Reagan proved deficits don't matter." What does matter for the GOP, though, is the uninterrupted flow of income to the wealthiest Americans needing it least.

And on that score, Republicans have been wildly successful. Income inequality is not merely at record levels; between 1976 and 2007, 58% of real income growth went to the top 1%. To be sure, the deficit-exploding Bush tax cuts played an essential role in fueling the gap. (This is evidenced by the fact that between 2001 and 2007, the income share of the 400 richest American taxpayers doubled even as their tax rates were halved.) As the New York Times revealed in October, by 2007 the top 1% - the 1.5 million families earning more than $400,000 - reaped 24% of the nation's income. The bottom 90% - the 136 million families below $110,000 - accounted for just 50%.

But for Republicans, taxes must stay low for the rich, even if, contrary to the teachings of Arthur Laffer, the deficit swells. In 2007, Laffer rationalized it this way:

"You really can't collect much money from upper-income people. They know how to get around taxes."

Or as President Bush explained in 2004 why his tax cuts for the wealthy should stay in place:

"The really rich people figure out how to dodge taxes anyway."

UPDATE: The latest to debunk this right-wing fraud is none other than Alan Greenspan. The disgraced "Maestro" who helped sell the Bush tax cuts to Congress in 2001 now believes the deficit requires that lawmakers "should follow the law and let them lapse."

(This piece also appears at Perrspectives.)