That all six of the Republicans selected to the Congressional debt reduction "Super Committee" are signers of Grover Norquist's anti-tax pledge is hardly surprising. But the choice of Arizona Senator Jon Kyl, is an especially fitting one for the GOP. After all, Kyl didn't merely define a generation of Republican talking points when he explained earlier this year that his was "not intended to be a factual statement." As it turns out, from regurgitating bogus claims that "tax cuts pay for themselves" and spur "job creators" to his war on the estate tax, Jon Kyl has long been a leading fabricator of GOP tax cut myths. And when it comes to super lies on taxes, his fellow Republican super committeemen are not far behind.

In June, the second ranking Senate Republican joined House Majority Leader Eric Cantor in walking out of debt reduction talks led by Vice President Biden because of their refusal to accept even a dime of new tax revenue. As Jon Kyl explained last summer (starting around the 1:20 mark above), tax cuts don't increase the national debt:

"You do need to offset the cost of increased spending, and that's what Republicans object to. But you should never have to offset cost of a deliberate decision to reduce tax rates on Americans."

Kyl's was just the latest repackaging of President Bush's long ago debunked claim that "you cut taxes and the tax revenues increase." Texas Senator Kay Bailey Hutchison parroted that line, "Every major tax cut we've had in history has created more revenue." Then House Minority Leader John Boehner agreed, insisting last June that the Bush tax cuts had nothing to do with the depleted U.S. Treasury, "It's not the marginal tax rates ... that's not what led to the budget deficit. The revenue problem we have today is a result of what happened in the economic collapse some 18 months ago." For his part, Senate Minority Leader Mitch McConnell rushed to defend Kyl's fuzzy math:

"There's no evidence whatsoever that the Bush tax cuts actually diminished revenue. They increased revenue because of the vibrancy of these tax cuts in the economy. So I think what Senator Kyl was expressing was the view of virtually every Republican on that subject."

That view may be Republican orthodoxy, but it also happens to be untrue.

It's not just that Uncle Sam's cash flow from individual income taxes did not return to its pre-Bush tax cut level until 2006:

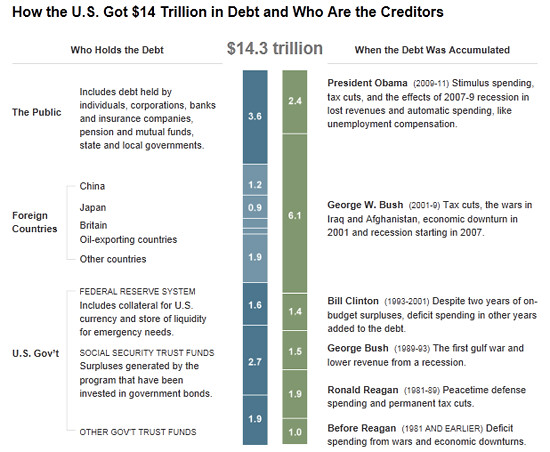

As the Washington Post summed up the CBO's conclusions regarding the causes of the nation's mounting debt earlier this year, "The biggest culprit, by far, has been an erosion of tax revenue triggered largely by two recessions and multiple rounds of tax cuts." A recent analysis by the New York Times echoed that finding:

With President Obama and Republican leaders calling for cutting the budget by trillions over the next 10 years, it is worth asking how we got here -- from healthy surpluses at the end of the Clinton era, and the promise of future surpluses, to nine straight years of deficits, including the $1.3 trillion shortfall in 2010. The answer is largely the Bush-era tax cuts, war spending in Iraq and Afghanistan, and recessions.

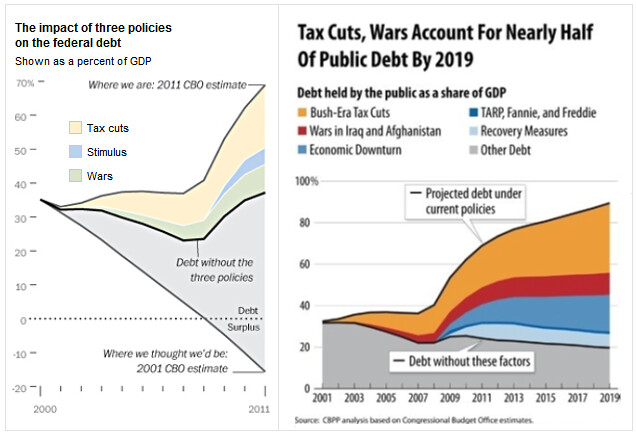

But as Ezra Klein explained in the Washington Post, the revealing Times chart doesn't tell the full story of the impact of Bush-era policies on future debt facing Barack Obama:

What's also important, but not evident, on this chart is that Obama's major expenses were temporary -- the stimulus is over now -- while Bush's were, effectively, recurring. The Bush tax cuts didn't just lower revenue for 10 years. It's clear now that they lowered it indefinitely, which means this chart is understating their true cost. Similarly, the Medicare drug benefit is costing money on perpetuity, not just for two or three years. And Boehner, Ryan and others voted for these laws and, in some cases, helped to craft and pass them.

These two graphs from the Washington Post and the Center on Budget and Policy Priorities make that point crystal clear. Analyses by CBPP showed that the Bush tax cuts accounted for half of the deficits during his tenure, and if made permanent, over the next decade would cost the U.S. Treasury more than Iraq, Afghanistan, the recession, TARP and the stimulus - combined.

Utah Senator Orrin Hatch was telling the truth when he described Republican fiscal mismanagement during the Bush years by acknowledging, "It was standard practice not to pay for things."

Jon Kyl's tax fraud hardly ends there. Two weeks ago, he used the Republican weekly radio address to restate the GOP's "job creators" myth ("job-killing tax increases are the wrong medicine"). But it was Speaker Boehner who in May articulated that tried and untrue GOP talking point in its purest form:

"The top one percent of wage earners in the United States...pay forty percent of the income taxes...The people he's [President Obama] is talking about taxing are the very people that we expect to reinvest in our economy."

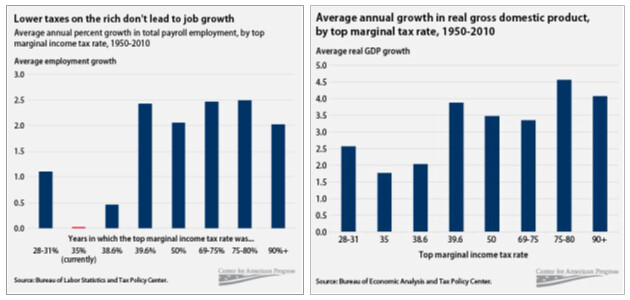

If so, the Republicans' so-called "Job Creators" failed to meet those expectations under George W. Bush. After all, the last time the top tax rate was 39.6 percent during the Clinton administration, the United States enjoyed rising incomes, 23 million new jobs and budget surpluses. Under Bush? Not so much.

On January 9, 2009, the Republican-friendly Wall Street Journal summed it up with an article titled simply, "Bush on Jobs: the Worst Track Record on Record." (The Journal's interactive table quantifies his staggering failure relative to every post-World War II president.) The meager one million jobs created under President Bush didn't merely pale in comparison to the 23 million produced during Bill Clinton's tenure. In September 2009, the Congressional Joint Economic Committee charted Bush's job creation disaster, the worst since Hoover:

As David Leonhardt of the New York Times aptly concluded last year:

Those tax cuts passed in 2001 amid big promises about what they would do for the economy. What followed? The decade with the slowest average annual growth since World War II. Amazingly, that statement is true even if you forget about the Great Recession and simply look at 2001-7.

The data are clear: lower taxes for America's so called job-creators don't mean either faster economic growth or more jobs for Americans.

In the decade since receiving the massive tax cut windfall, Jon Kyl's job creators didn't create any jobs. But they did see their tax rates plummet even as income inequality hit the highest level record since 1929. Nevertheless, Jon Kyl needed to make sure winners of the class war won even more. Which is why Kyl played a pivotal role in slashing the federal estate tax.

The Republican scam over the so-called "death tax" is as bogus now as it was when President Bush first perpetrated it ten years ago. As John Boehner put it:

"People who aren't wealthy, who may have built up value in land over generations and many family farms find themselves in situations where they've got to sell the farm in order the pay the taxes."

The Bush tax cuts passed in 2001 raised the estate tax threshold from $1 million to $3.5 million ($7 million for a couple), while slashing the rate from 55 percent to 45 percent. But facing the "sunset" provision that would eliminate the estate tax for one year in 2010 before returning to the pre-2001 levels the following year, the House voted 225-200 in early December 2009 for an extension to maintain 2009's 45 percent rate. But in the Senate Jon Kyl stopped that compromise cold:

"It's a problem that doesn't have to exist if they'll just leave the existing law alone and let the rate go to zero, which is where everyone wants it to be."

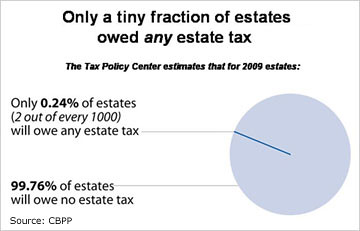

By everyone, Jon Kyl meant the handful of the wealthiest families in America paying the estate tax each year.

In April 2009, the Tax Policy Center quantified just how few family farms or small businesses are actually impacted by the estate tax proposals under consideration:

We estimate that under the Obama proposal, 100 family farms and businesses would owe tax. (We define such estates as those where farm or business assets are valued at under $5 million and comprise the majority of estate assets.) The Lincoln-Kyl proposal would cut the number to 40. Even under current law, fewer than 2,700 family farms and businesses would owe tax.

In the two-year extension of the Bush tax cuts extorted by Republicans in December 2010, Jon Kyl (aided and abetted the former Senator from Wal-Mart, Blanche Lincoln) succeeded in raising the asset cap while lowering the estate tax rate to 35 percent. The result, as Ezra Klein lamented, was a "noxious" tax cut for the richest 0.11% of Americans, one draining an additional $7 billion from the Treasury every year.

Of course, Jon Kyl has plenty of company when it comes to the tax cut super liars of the new debt super committee. Pennsylvania Senator Pat Toomey, the former Club for Growth president who emerged as one of the leading "default deniers" during the just concluded debt ceiling crisis, told Fox News last fall that "it's not clear" that extending the Bush tax cuts and cutting corporate taxes would decrease revenues. As ThinkProgress reported, Michigan Rep. Dave Camp argued for making the Bush tax cuts permanent by pretending "I don't think you have to pay for extensions of current law" and insisting he'd rather have a bigger deficit than see taxes go up on "rich people." That was reflected in Camp's proposal in March to slash the top personal income and corporate tax rates to 25 percent, which as even the Wall Street Journal admitted, "might require Congress to find $2 trillion in new revenue over a decade if Mr. Camp wants to offset the entire cost."

Then there's Texas Congressman Jeb Hansarling. Hensarling, who in the spring of 2009 brushed off the deepening Bush recession as just "part of freedom," claimed two weeks ago that for Republicans raising the debt ceiling is "contrary to our DNA."

Which means Jeb Hensarling is as bad at genetics as he is at history and math. Leave aside for the moment that small government icon Ronald Reagan tripled the national debt and signed 17 debt ceiling increases into law. (That might explain why the Gipper repeatedly demanded Congress boost his borrowing authority and called the oceans of red ink he bequeathed to America his greatest regret.) As it turns out, Republican majorities voted seven times to raise the debt ceiling - and double the national debt - under President Bush. The current GOP leadership team voted a combined 19 times to bump the debt limit $4 trillion during his tenure. That vote tally included a "clean" debt ceiling increase in 2004, backed by 31 sitting GOP Senators and 98 current House Republicans. Including, it turns out, Jeb Hensarling.

A particularly telling moment for the GOP's debt super committee super liars during a January 2010 gathering of the House Republican caucus with President Obama. When Jeb Hensarling declared "the old annual deficits under Republicans have now become the monthly deficits under Democrats," President Obama set him straight:

"Now, look, let's talk about the budget once again, because I'll go through it with you line by line. The fact of the matter is, is that when we came into office, the deficit was $1.3 trillion. -- $1.3 [trillion.] So when you say that suddenly I've got a monthly budget that is higher than the -- a monthly deficit that's higher than the annual deficit left by the Republicans, that's factually just not true, and you know it's not true."

The same could be said for all of the super lies the Republican debt supermen have to say about taxes.

(This piece also appears at Perrspectives.)