In a new Gallup poll released Wednesday, small business owners revealed that the lack of need for new employees (76 percent), worries over revenue (71 percent) and concern about the state of the U.S. economy (66 percent) were the top three reasons for not hiring new workers. But you'd never know that if you just glanced at Gallup's headline, which instead warned, "Health Costs, Gov't Regulations Curb Small Business Hiring." Predictably, and despite a mountain of surveys and analyses showing that weak customer demand and not "job-crushing regulations" tops small businesses' concerns, Speaker John Boehner and the conservative blogosphere are touting Gallup's misleading headline.

On Wednesday, Gallup published this table summing up the results of its latest Wells Fargo/Small Business Index survey:

Interestingly, Gallup's headline and subhead included none of the top four factors small businesses cited as reason for not hiring. Instead, the pollsters led with the fifth and sixth items found well down the list:

While Gallup has done Americans no favors by misrepresenting its own poll results, it has done a great service for Republican propagators of long-debunked talking points. As a quick glance at Republican debate transcripts shows, the 2012 GOP presidential candidates fight each other to out-repeal regulations "off the throat of small business operators." Dire warnings about "job-destroying regulations" are regularly regurgitated by Republican leaders including Mitch McConnell, John Boehner and Eric Cantor.

Sadly for the conservative tall tale-tellers, overly zealous government regulation has little to do with the woes of America's businesses large and small.

Weak consumer demand is another matter. As the Washington Post recently explained:

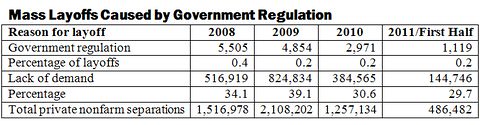

Data from the Bureau of Labor Statistics show that very few layoffs are caused principally by tougher rules.

Whenever a firm lays off workers, the bureau asks executives the biggest reason for the job cuts.

In 2010, 0.3 percent of the people who lost their jobs in layoffs were let go because of "government regulations/intervention." By comparison, 25 percent were laid off because of a drop in business demand.

Last October, former Reagan Treasury official Bruce Bartlett hammered home the same point.

Evidence supporting Mr. Cantor's contention that deregulation would increase unemployment is very weak...The table below presents the bureau's data. As one can see, the number of layoffs nationwide caused by government regulation is minuscule and shows no evidence of getting worse during the Obama administration. Lack of demand for business products and services is vastly more important.

CNN recently reached the same conclusion. Asking "Is government regulation really holding back the labor market?," CNN answered, "Not so much, according to government data and surveys of business owners and economists."

Only a small percentage of employers report regulation as a reason for laying off workers...And a CNNMoney survey of economists conducted in the second quarter delivered similar results. Only a couple of the 16 economists questioned said government regulation was the biggest drag on the labor market.

The reliably Republican Wall Street Journal agreed. Its July survey of business economists concluded, "The main reason U.S. companies are reluctant to step up hiring is scant demand, rather than uncertainty over government policies."

Surveys of small business owners confirmed that assessment. In September, McClatchy found little evidence to support the GOP claims that "blame excessive regulation and fear of higher taxes for tepid hiring in the economy." Instead, its canvass of a random sample of small business owners across the nation revealed:

Their response was surprising.

None of the business owners complained about regulation in their particular industries, and most seemed to welcome it. Some pointed to the lack of regulation in mortgage lending as a principal cause of the financial crisis that brought about the Great Recession of 2007-09 and its grim aftermath.

Small Business Majority found the same dynamic at work this summer. As Bartlett summed up its survey which asked 1,257 small business owners to name the two biggest problems they face:

Only 13 percent listed government regulation as one of them. Almost half said their biggest problem was uncertainty about the future course of the economy -- another way of saying a lack of customers and sales.

Last year, the not-for-profit advocacy group, Small Business Majority also found that the new incentives included in the Affordable Care Act were spurring business owners to add insurance for their employees:

Small Business Majority commissioned a survey of 619 small business owners with fewer than 50 employees from Nov. 17-22, 2010. We wanted to gauge their opinions on two key provisions of the Patient Protection and Affordable Care Act: healthcare tax credits and insurance exchanges. For employers who don't offer health insurance, one-third said they are more likely to do so because of the tax credits, and 31% of employers who currently offer it said the tax credits will make them more likely to continue offering it. The credits, which are available now, allow businesses with fewer than 25 employees that have average annual wages under $50,000 to get a tax credit of up to 35% of their health insurance costs.

The numbers were nearly identical when respondents were asked if the exchange will make them more likely to provide benefits: 33% of respondents who don't provide insurance said the exchange would make them more likely to do so, and 31% who do provide insurance responded that the exchange would make them more likely to continuing providing it. The insurance exchanges are online marketplaces where small businesses and individuals can band together to buy insurance.

Evaluating those incentives to purchase insurance for her employees, Kiersten Firquain of Kansas City-based Bistro Kids responded, "We said, 'How could we not do this?'"

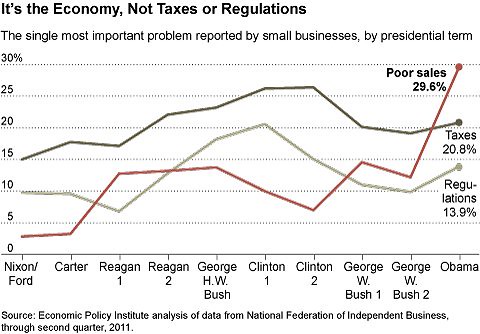

In his demolition of the Republicans' regulatory uncertainty myth, Larry Mishel of the Economic Policy Institute produced the data and charts to debunk their bogus claim. "If one looks at what employers are doing rather than what the trade associations and their allies on Capitol Hill are saying, then recent employment and investment behavior is easy to explain—investment and employment/unemployment are what we would expect in a severe downturn followed by a slow-growing economy in the recovery," Mishel concluded, adding, "There is no shift from historic patterns, and there does not seem to be any evidence that fears of future regulation are shaping the slow growth and weak employment gains we have seen." And echoing other recent polling on the subject, he found:

What businesses (and business economists) say in private surveys also does not support the "regulatory uncertainty" mantra one hears from the D.C.-based business trade associations..

The National Federation of Independent Business (NFIB), which describes itself as "the leading small business association representing small and independent businesses," does a regular survey of small businesses. One question that has been asked since 1973, is "what is the single most important problem your business faces?" The answer choices are inflation, taxes, government regulation, poor sales, quality of labor, interest costs, health insurance costs, the cost of labor, and other matters. Interestingly, the single largest response is "poor sales," the choice of 30 percent of respondents since President Obama was sworn in (averaging the 10 quarters between early 2009 and spring 2011). In other words, slack demand appears to be the key concern of small businesses.

The debunking hardly ends there. Last fall, a World Bank report found that the U.S. ranked fourth is ease of doing business, behind only Hong Kong, Singapore and New Zealand. An analysis of the U.S. money supply by Moebs Services concluded:

The uncertainty plaguing the American economy has nothing to do with government regulations or taxes on millionaires. It's an uncertainty driven squarely by consumers and small-businesses who are worried about their short-term financial prospects. And it's been going on since well before Obama took up residence in the White House.

Even an October Gallup poll which reported that 22 percent of small business owners put complying with government regulation at the top of their list of concerns, also said that increased sales and broader job creation in the economy were their top two factors for success in 2012. And as Bloomberg explained three weeks ago:

Obama's White House has approved fewer regulations than his predecessor George W. Bush at this same point in their tenures, and the estimated costs of those rules haven't reached the annual peak set in fiscal 1992 under Bush's father, according to government data reviewed by Bloomberg News.

Taken together, the overwhelming evidence shows the Republicans' regulatory fraud is just that. As Bartlett aptly described it, the GOP's anti-regulatory jihad "is a simple case of political opportunism, not a serious effort to deal with high unemployment." The same is true of the GOP's tax cut mythology, which the record shows has only served to deliver yet another Treasury-funded windfall to the wealthy. At the end of the day, Republicans' claims about cutting taxes and regulations are obviously false, even if their ideology demands they be true. And this week, Gallup helped them perpetrate that fraud.

(This piece also appears at Perrspectives.)