While the Occupy Wall Street movement and a shocking report from the Congressional Budget Office have shone a bright spotlight on America's record income inequality, the GOP's 2012 presidential field is proposing massive new tax cuts certain to expand that Grand Canyon-sized gap between the fabulously rich and everyone else. Of course, the gilded-class giveaways from Rick Perry, Mitt Romney and Herman Cain are just the latest chapters in the GOP's decade-long campaign of upward income redistribution. As a quick glance at the plans of George W. Bush, John McCain and Paul Ryan shows, winner-take-all tax cuts have long been the defining feature of the Republican Party.

Rick Perry

Five days after reporting "GOP presidential candidates' tax plans would benefit the rich," the McClatchy Papers detailed the Texas Governor Rick Perry's pay day for plutocrats.

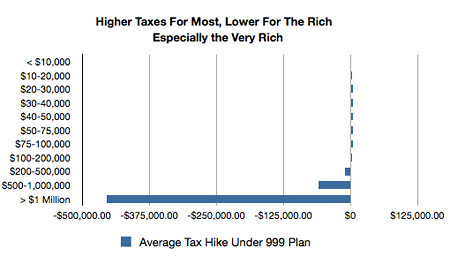

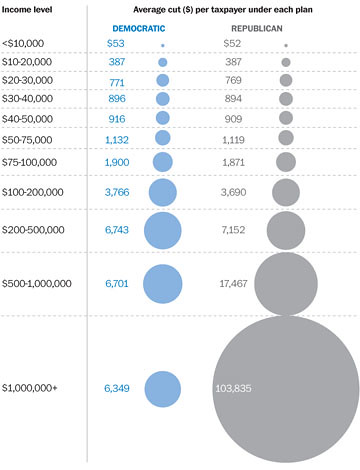

As McClatchy explained the chart above:

Rick Perry's proposed optional flat tax would be a windfall for wealthier Americans, giving millionaires an average tax cut of $637,418, according to an analysis by the nonpartisan Tax Policy Research Center released Monday.

While the tax cuts would be greatest at the top of the income scale, Perry's proposal would give all taxpayers at least some tax cut, according to the analysis. Those making less than $10,000, for example, would get an average tax cut of $28.

It's no wonder that when John Harwood said on CNBC that the richest Americans would get back "hundreds of thousands, maybe even millions of dollars" annually from the U.S. Treasury courtesy of Perry's tax plan, the Governor replied, "I don't care about that."

Which is quite evident from Perry's plan. His optional 20 percent flat tax rate would allow the top income earners to pay Uncle Sam at a much lower rate than the already low 35 percent level they pay currently. And Perry would not merely eliminate the estate tax, he would zero out the capital gains tax as well.

Which is also why Perry's reward for the rich would cost the Treasury an estimated $995 billon a year in lost revenue. Despite his balanced budget pledge, Perry claims that red ink is no problem. "There's nothing wrong," he said, "with lower revenue."

Herman Cain

As James Fallows pointed out Tuesday, Herman Cain's taxpayer-funded payback to the rich also runs off the page.

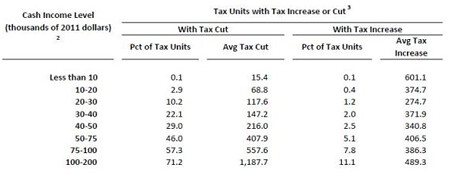

Still, Perry's plan pales in comparison to Herman Cain's 9-9-9 reward for the rich. As the Tax Policy Center documented, Cain's simple sound bite would slash taxes for millionaires by an average of $455,000 each, while raising taxes on virtually everyone else:

At the same time, those with incomes below $200,000 - 84 percent of taxpayers - would see their taxes increase under the Cain plan, according to the analysis.

As the Washington Post's Ezra Klein showed using the TPC data, while raising taxes on most Americans Cain's payday to the richest is literally off the charts. As Klein explained last week, "One problem with trying to graph the 9-9-9 plan is that the tax cuts for the rich are so large that it's hard to see what the policy is doing to the poor and the middle class. That's why I posted a table rather than a chart earlier."

That's what necessarily happens when you cut the top income tax rate from 35% to 9%, eliminate the Earned Income Tax Credit for working Americans, and zero out the capital gains tax. (According to the Joint Committee on Taxation, two-thirds of all capital gains are reported by those with incomes over $1 million.) As Center for American Progress Vice President for Economic Policy Michael Ettlinger put it:

"[Herman Cain's 9-9-9 plan] would be the biggest tax shift from the wealthy to the middle-class in the history of taxation, ever, anywhere."

Mitt Romney

While Mitt Romney has not yet drunk the flat tax Koolaid (a politically delicate maneuver for man worth at least $250 million), his 59-point, 162-page proposal would nevertheless deliver another bonanza for the trust fund set. As for his claim that "The people in the middle...I focused my tax cut right there," not so much.

Romney may think he focused his tax cut on the middle-class, but according to a ThinkProgress analysis of Tax Policy Center data*, nearly three-fourths of households that make $200,000 or less annually would get literally nothing from Romney's tax cut, due to the simple fact that most of those households have no capital gains income.

Nonetheless, with its call to make the Bush tax cuts permanent, cut the top individual and corporate tax rate and end the estate tax, Romney's proposal would produce another pay-out for the plutocracy while the Treasury hemorrhaged red ink. As ThinkProgress summed it up:

Romney's tax plan includes a $6.6 TRILLION giveaway to corporations and the wealthiest Americans. Meanwhile, Romney's Medicaid cuts are even more draconian than the ones in Paul Ryan plan. Both of their plans end also end Medicare, naturally.

Paul Ryan's GOP Budget

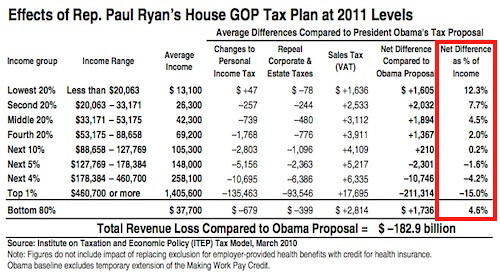

As Michael Linden of the Center for American Progress explained, Paul Ryan's scheme backed by 98% of Congressional Republicans offered yet another cornucopia for the wealthy. (Unlike Cain's plan, the Ryan proposal omits any mention of the tax preference and loopholes it claims to close. Like most other would-be Republican tax reformers, Ryan avoids that politically dangerous work, insisting instead that "Ways and Means will have to fill in those details.") While the tax breaks to be ended remains unknown, Linden explained, "Here's what we do know. Ryan's plan would":

Maintain the Bush tax cuts, and further, cut the top individual tax rate down to 25 percent from 35 percent;

Consolidate the current six tax brackets into some, unspecified, fewer number of brackets;

Keep overall revenue levels the same;

Pay for the enormous tax cut for the top by eliminating or curtailing some, unspecified, tax expenditures.

The result is inevitably yet another huge payday for the gilded-class. While claiming to close existing loopholes in order to produce a "revenue neutral" result, Paul Ryan's brave new world would be a beautiful one for the rich and a dystopian nightmare for almost everyone else.

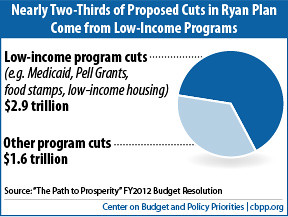

As the Center on Budget and Policy Priorities explained, the savings from Ryan's draconian budget cuts (three quarters of which are extracted from the poor elderly) are almost completely offset by his $4.2 trillion in tax cuts.

And as Matthew Yglesias explained in April, earlier analyses of the proposals in Ryan's Roadmap reveal that working Americans would have to pick up the tab left unpaid by upper-income households:

This is an important element of Ryan's original "roadmap" plan that's never gotten the attention it deserves. But according to a Center for Tax Justice analysis (PDF), even though Ryan features large aggregate tax cuts, ninety percent of Americans would actually pay higher taxes under his plan.

In other words, it wasn't just cuts in middle class benefits in order to cut taxes on the rich. It was cuts in middle class benefits and middle class tax hikes in order to cut taxes on the rich. It'll be interesting to see if the House Republicans formally introduce such a plan and if so how many people will vote for it.

We now know the answer to Yglesias' question. 235 House Republicans and 40 GOP Senators voted for Paul Ryan's budget this past spring.

Making the Bush Tax Cuts Permanent

Two months after President Obama and Congressional Republicans inked an $800 billion package extending the Bush tax cuts for two years, in February Republican colleagues Jim Demint (R-SC) and Mike Pence (R-IN) proposed making the budget-busting, Treasury draining Bush tax cuts permanent.

What Demint and Pence call the "Tax Relief Certainty Act" is certain only to pile up trillions of new debt. After all, last year the CBO and others estimated the 10 year cost of making the Bush tax cuts permanent at roughly $3.8 trillion.

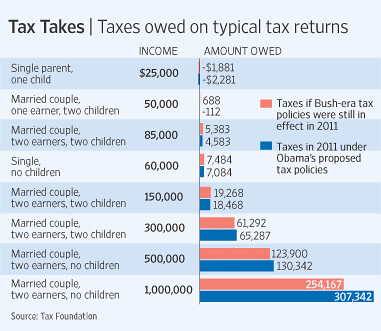

As the debate over the expiring Bush tax cuts heated up in the fall of 2010, the Joint Committee on Taxation examined the impact of the Democratic proposal to let them lapse for just the top bracket households making over $250,000 year. "Taxpayers with income of more than $1 million for 2011 would still receive on average a tax cut of about $6,300 compared with what they would have paid under rates in effect until 2001", the New York Times reported, adding, "that compares, however, with the roughly $100,000 average tax cut that households with more than $1 million in income would receive under current rates." In words and pictures, The Washington Post explained the payday for the rich if the GOP got its way:

New data from the nonpartisan Joint Committee on Taxation show that households earning more than $1 million a year would reap nearly $31 billion in tax breaks under the GOP plan in 2011, for an average tax cut per household of about $100,000.

In July 2010, the reliably Republican Wall Street Journal offered its own pretty picture of the contending Democratic and Republican tax proposals. Despite GOP mythmaking about a "$3.8 trillion tax increase" and the "ticking tax bomb," President Obama and his Democratic allies are offering middle class Americans greater tax relief at virtually income level:

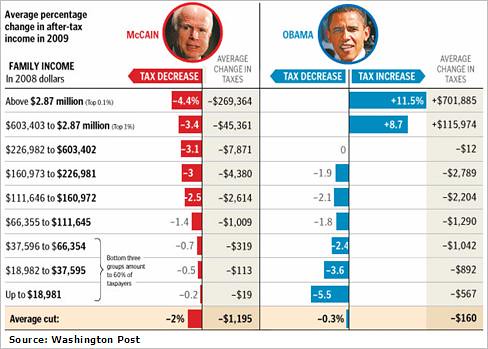

Of course, the same conflict over the fate of the upper-class Bush tax cuts played out during the 2008 campaign between Barack Obama and John McCain. As the Washington Post detailed at the time, an analysis by the Tax Policy Center showed:

"Obama's plan gives the biggest cuts to those who make the least, while McCain would give the largest cuts to the very wealthy."

Those whose incomes were under $67,000 - 60% of all American taxpayers - would see substantially larger tax cuts under the Obama plan. While McCain's plan concentrated 58% of its benefits to the wealthiest 1% of Americans, Obama's proposed rollback of the Bush tax cuts above $250,000 produces tax increases for that group. (That analysis understated the impact of John McCain's gift to the rich. Later in 2008, McCain called for halving the capital gains tax to 7.5 percent, which would have produced yet another windfall for the wealthy and his own family.)

A Decade of the Bush Tax Cuts

In February 2004, President George W. Bush crowed, "We cut taxes, which basically meant people had more money in their pocket."

Of course, some people are more equal than others.

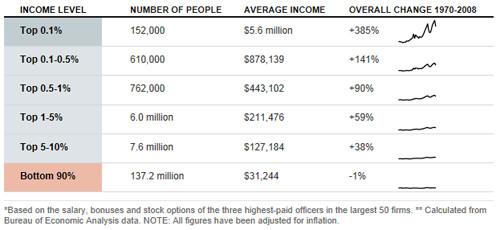

As the Center for American Progress noted in 2004, "for the majority of Americans, the tax cuts meant very little," adding, "By next year, for instance, 88% of all Americans will receive $100 or less from the Administration's latest tax cuts."

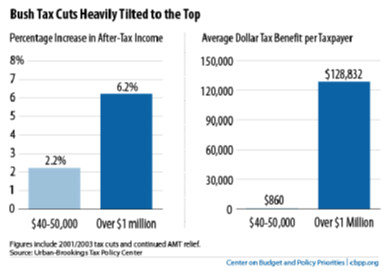

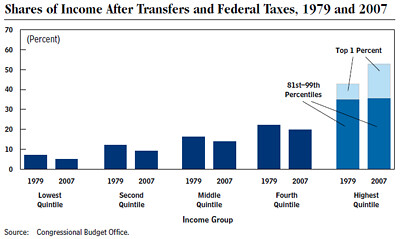

But that's just the beginning of the story. As the CAP also reported, the Bush tax cuts delivered a third of their total benefits to the wealthiest 1% of Americans. And to be sure, their payday was staggering. The Center on Budget and Policy Priorities detailed that by 2007, millionaires on average pocketed $120,000 from the Bush tax cuts of 2001 and 2003. Those in the top 1% stashed an extra $45,000 a year. As a result, millionaires saw their after-tax incomes rise by 7.6%, while the gains for the middle quintile and bottom 20% of Americans were a paltry 2.3% and 0.4%, respectively.

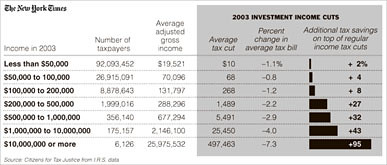

And as the New York Times uncovered in 2006, the 2003 Bush dividend and capital gains tax cuts offered almost nothing to taxpayers earning below $100,000 a year. Instead, those windfalls reduced taxes "on incomes of more than $10 million by an average of about $500,000." As the Times explained in a shocking chart: "The top 2 percent of taxpayers, those making more than $200,000, received more than 70% of the increased tax savings from those cuts in investment income."

It's no wonder that between 2001 and 2007, the 400 richest taxpayers saw their incomes double to an average of $345 million even as their effective tax rate was virtually halved. As the Washington Post noted, "The 400 richest taxpayers in 2008 counted 60 percent of their income in the form of capital gains and 8 percent from salary and wages. The rest of the country reported 5 percent in capital gains and 72 percent in salary."

And so it goes. On the same day the CBO reported that "top earners doubled share of nation's income," a new CBS/New York Times poll last week found:

"Two-thirds of the public said that wealth should be distributed more evenly in the country. Seven in 10 Americans think the policies of Congressional Republicans favor the rich. Two-thirds object to tax cuts for corporations and a similar number prefer increasing income taxes on millionaires."

Americans have heard the Republican story before. And no matter how Mitt Romney, Herman Cain, Rick Perry or any other of the GOP White House hopefuls tell it, the ending is always the same:

(This piece also appears at Perrspectives.)