The Trump administration, as have all Republican administrations, is promoting tax cuts for the rich, saying they will "create growth." Never mind the destructive history of tax cuts, the destructive history of "trickle-down economics" (and the destructive history of Republican administrations generally) -- they're doing it again.

Getting A Few Bamboozlements Out Of The Way

Any time taxes come up, decades of Republican bamboozlement gets in the way of rational discussion. Republicans say things like "taxes take money out of the economy" and "tax cuts create growth" to trick people into supporting tax cuts for the rich and corporations (which are really just more tax cuts for the rich).

So it is reasonable to look at what has actually happened when taxes on the rich have been cut. History shows that tax cuts have never produced "growth." (See also, the Congressional Research Service's non-partisan study, "Taxes and the Economy: An Economic Analysis of the Top Tax Rates Since 1945": "Analysis of such data suggests the reduction in the top tax rates have had little association with saving, investment, or productivity growth." Also, take a look at what happened in Kansas and six other states when they tried to grow their economies through tax cuts.)

Tax Cuts Defund Our Democracy And Concentrate Power At The Top

So tax cuts do not "grow the economy." They just don't. But tax cuts and the resulting drop on revenue to our democracy are used to force cuts in the things our government does to make our lives better and help our economy prosper in the longer term.

When people have a say in how their government is run they say they want good schools and colleges, good infrastructure, health care, scientific research, good courts, and all the things that government can do to make our lives better. They also say they want a "flatter" wealth distribution, with people at the bottom having a way to make a living, and people at the top helping pay for our democracy by pitching in more of the gains that democracy brings.

When people don't have a say in how their government is run, the economy delivers for a few at the top while leaving the rest behind. And this concentration of wealth also concentrates their power over our governmental decision-making.

Tax cuts don't just force a drop in revenue to our democracy, they push the benefits of our economy to a few at the top. The Congressional Research Service study mentioned above, Taxes and the Economy: An Economic Analysis of the Top Tax Rates Since 1945, found that tax cuts do not bring economic growth. The study also found, "However, the top tax rate reductions appear to be associated with the increasing concentration of income at the top of the income distribution."

Democracies demand high taxes at the top because the revenue is good for the economy in the long term. Taxes bring in revenue to pay for education, scientific research and improvements in infrastructure that cause the economy to grow. Investing in modern transit systems, smart grid, energy efficiency, fast internet and other improvements leads to a huge payoff. Infrastructure improvement and maintenance is the “seed corn” of economic growth. We have been eating that seed corn since Reagan’s tax cuts. Prosperity is the fruit of democracy.

Tax cuts do not "take money out of the economy"; they redistribute it to places where We the People decide it can be better used to help make all of our lives better and grow our economy. But the Reagan tax cuts were used to force cuts in things like education, scientific research and, unfortunately, maintaining and modernizing our infrastructure.

Our economy has been in trouble ever since. From the 2010 post, Reagan Revolution Home To Roost — In Charts:

Working people’s share of the benefits from increased productivity took a sudden turn down:

This resulted in intense concentration of wealth at the top:

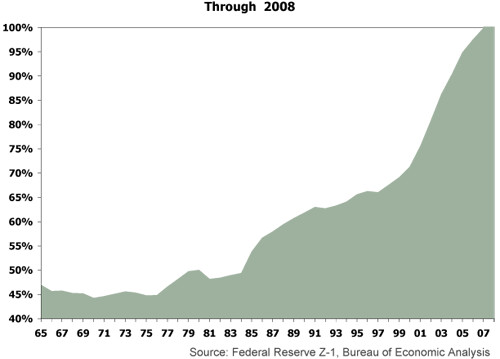

And forced working people to spend down savings to get by:

Which forced working people to go into debt: (total household debt as percentage of GDP)

None of which has helped economic growth much: (12-quarter rolling average nominal GDP growth.)*

Tax cuts steal from democracy.

Tax Cuts Force Unsustainable Business Models

The dramatic decrease in top tax rates has also forced unsustainable "sell the farm" business models.

From the 2010 post 14 Ways A 90 Percent Top Tax Rate Fixes Our Economy And Our Country:

A return to Eisenhower-era 90% top tax rates helps fix our economy in several ways:

1) It makes it take longer to end up with a fortune. In fact it makes people build andearn a fortune, instead of shooting for quick windfalls. This forces long-term thinking and planning instead of short-term scheming and scamming. If grabbing everything in sight and running doesn’t pay off anymore, you have to change your strategy.

2) It gets rid of the quick-buck-scheme business model. Making people take a longer-term approach to building rather than grabbing a fortune will help reattach businesses to communities by reinforcing interdependence between businesses and their surrounding communities. When it takes owners and executives years to build up a fortune they need solid companies that are around for a long time. This requires the surrounding public infrastructure of roads, schools, police, fire, courts, etc., to be in good shape to provide long-term support for the enterprise. You also want your company to build a solid reputation for serving its customers rather than cheapening the product, pursuing quick-buck scams, cutting customer service, etc. The current Wall Street/private equity business model of looting companies, leaving behind an empty shell, unemployed workers and a surrounding community in devastation will no longer be a viable business strategy.

3) It will lower the executive crime rate. Today it is possible to run scams that let you pocket huge sums in a single year, and leave behind the mess you make for others to fix. A high top tax rate removes the incentive to lie, cheat and steal to grab every buck you can as fast as you can. This reduces the temptation to be dishonest. If you aren’t going to keep the whole dime, why risk doing the time? When excessive, massive paydays are possible, it opens the door to overwhelming greed and a resulting compromising of principles. Sort of the definition of the decades since Reagan, no?

Who Pays For Tax Cuts?

Conservative economics claims that tax cuts do not have to be "paid for." (Modern Monetary Theory shows otherwise, but that's for another post.)

Trump uses the old "tax cuts pay for themselves" bamboozlement to claim that much of the revenue lost from his tax cuts will be made up for by increased growth. They won't, of course. Trump also throws in a number of things that will actually increase taxes on the non-rich, while hurting homeowners and nonprofit organizations.

One place the Trump tax cuts plan to "pay for" the huge windfall for the rich is by limiting or eliminating the mortgage interest tax deduction.

Another "pay for" is eliminating tax deductions for charitable giving. In "Will Trump's Tax Plan Hurt Philanthropy?" Ben Paynter explains what this will do to nonprofits.

"In the long run, the Center for Effective Government estimates that the proposed policy could reduce cause organization funding by $9.1 billion annually. And United Way Worldwide has reported that nearly two-thirds of Americans might reduce giving by 25% or more."

Marques Chavez of The Alliance for Charitable Reform names a few names, in a letter to the editor that appeared in The Hill

"The Tax Policy Center found that a cap on the charitable deduction, as proposed by President Trump, would cost as much as $26 billion in charitable giving in one year. That is more than the combined operating budgets of the American Red Cross, Goodwill Industries International, YMCA of the USA, Habitat for Humanity, Boys and Girls Clubs of America, Catholic Charities USA, the American Cancer Society, United Way Worldwide and Feeding America."

What tax cuts actually do is steal our democracy out from under us.

The Republican Congress and President Trump are proposing more huge tax cuts for the rich and corporations. Call your member of Congress and your senators, and visit their offices, to let them know how you feel about this. Join #ResistTrumpTuesdays here.

You can find local actions here and a local #Indivisible group here.

-------

This post originally appeared at Campaign for America's Future (CAF) at their OurFuture site. I am a Fellow with CAF, a project of People's Action. Sign up here for the OurFuture daily summary and/or for People's Action's Progressive Breakfast.