Among the things largely absent from the 2012 Republican National Convention has been any mention of Bain Capital and any fidelity to the truth. After the first two days, the GOP's twin frauds about welfare and "we built that" were once again demolished, prompting Team Romney to protest that "we're not going to let our campaign be dictated by fact checkers." Adding to the embarrassment was a prime-time presentation on how to build your small business by selling to the government.

As it turns out, the silence about Mitt Romney's old company (which only ended on the ceonvention's last night) and the Republican sham that "you didn't build it" are related. Because when it comes to Bain Capital, in a very real sense you did build it. After all, your United States tax code doesn't merely allow the "carried interest exemption" that enables the likes of Mitt Romney to pay a lower rate than many middle class families. Without the public subsidy that is the corporate debt interest deduction, there might not be a Bain Capital--or a private equity industry as we know it--at all.

As the history shows, on his road to becoming a $250 million captain of private equity at Bain Capital, Mitt Romney had a lot of help from his uncle. Uncle Sam, that is. Writing in Rolling Stone, Matt Taibbi explained how:

Essentially, Romney got rich in a business that couldn't exist without a perverse tax break, and he got to keep double his earnings because of another loophole - a pair of bureaucratic accidents that have not only teamed up to threaten us with a Mitt Romney presidency but that make future Romneys far more likely. "Those two tax rules distort the economics of private equity investments, making them much more lucrative than they should be," says Rebecca Wilkins, senior counsel at the Center for Tax Justice. "So we get more of that activity than the market would support on its own."

Then-Bain Capital CEO Mitt Romney concluded as much when he acknowledged, "There's a lot greater risk in a startup than there is in acquiring an existing company." So he fatefully redirected his firm from venture investments in new companies like Staples and instead became a leveraged buyout king. To understand both why he did that and how all American taxpayers helped make it possible, a little background is in order.

Private equity owes its success in no small part to that uniquely American provision of the corporate tax code. The New York Times recently helped explain why:

Companies can finance investment from either debt or equity. Companies can finance investment from either debt or equity. But profit on an investment financed with equity -- stock issued by the company -- is taxed. In contrast, if the project is financed with debt, then only the profit after interest payments are made is taxed. This means debt-financed investments are cheaper than equity.

And not just a little cheaper. As the Treasury Department recently explained, "The effective corporate marginal tax rate on new equity-financed investment in equipment is 37 percent in the United States. At the same time, the effective marginal tax rate on the same investment made with debt financing is minus 60 percent--a gap of 97 percentage points." The result:

This creates a bias by corporations toward debt.

Or, for the likes of Mitt Romney, a business model.

For the leveraged buyout (LBO) kings of the 1970's and 1980's, that was the pot of the gold at the end of the rainbow. Because the same interest deduction applied whether debt was taken on for a new factory or just to pay investors, Josh Kosman detailed in The Buyout of America, the early corporate raiders and their private equity successors could almost mint money as they bought firms for a fraction of the overall deal size:

Kohlberg saw a way to make debt far less onerous for the company being acquired. He would have the company treat its debt the way businesses handle capital expenditures--as operating expenses deduced from profits through the depreciation tax schedules, thereby greatly reducing taxes. With far less to pay the government, his companies could use the money that formerly went to Uncle Sam to retire these huge loans at an unusually fast rate. Bear's equity would rise with every dollar the companies paid back in debt, even if the value of the businesses only remained the same. The final step in the plan was to sell these companies, usually within four to six years.

In January, The Economist explained how the perverse incentives work:

From 2004 to 2011 private-equity firms piled more debt onto their companies so they could take out $188 billion in dividends to pay themselves. The deals got bigger and bigger. The largest ever, in 2007, was the $44 billion purchase of TXU, an electricity company. The market worries the company will go under.

But though the private-equity people may have walked off with the loot, America's tax code was partly to blame, because it encourages this behaviour. The tax deductibility of interest payments on debt gives private-equity executives an incentive to pile extra debt onto the companies they buy, thereby risking the health of these firms for the sake of a tax benefit and the prospect of higher returns.

"In the majority of these deals," Lynn Turner, former chief accountant of the Securities and Exchange Commission explained, "the tax deduction has a big enough impact on the bottom line that the takeover wouldn't work without it." And that interest," Turner said, "just sucks the profit out of the company." As Taibbi rightly noted, "You almost have to start firing people immediately just to get your costs down to a manageable level."

"Traditionally," Kosman noted in 2009, "cash-rich public companies have paid dividends to lure and reward investors." But private equity firms, he explained, stand this process on its head. "Fourteen of the largest American private equity firms had more than 40 percent of the North American companies they bought from 2002 until September 2006 pay them dividends," Kosman pointed out, adding, "In thirty-two of the eighty-three case, 38 percent, they took money out in the first year." And the innovator behind the business model?

Mitt Romney was a pioneer of this strategy. His private equity firm, Bain Capital, was the first large PE firm to make a serious portion of its money not from selling its companies or listing them on the stock exchange, but rather by collecting distributions and dividends, which in this context is the exact opposite of reinvesting in a company. Bain Capital is notorious for failing to plow profits back into its businesses.

So much for candidate Mitt Romney's 2007 claim, "Don't forget that when companies earn profit, that money is supposed to be reinvested in growth."

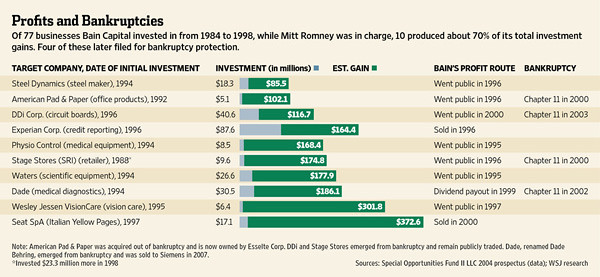

During his tenure as CEO from 1984 to 1999, Bain invested in 40 companies in the U.S. While seven later went bankrupt, in June the New York Times reported that "In some instances, hundreds of employees lost their jobs. In most of those cases, however, records and interviews suggest that Bain and its executives still found a way to make money." That mirrors a January 2012 analysis by the Wall Street Journal, which revealed:

Bain produced stellar returns for its investors--yet the bulk of these came from just a small number of its investments. Ten deals produced more than 70% of the dollar gains.

Some of those companies, too, later ran into trouble. Of the 10 businesses on which Bain investors scored their biggest gains, four later landed in bankruptcy court.

Put another way, Mitt Romney's investing was almost risk-free. He won when his portfolio companies won and often when they lost. Thanks in large part to the dangerous incentives unleashed by the U.S. tax code.

That's why Romney's former Bain colleague Marc Wolpow fretted, "I believed he was making a mistake by framing himself as a job creator." In reality, he insisted, "That was not his or Bain's or the industry's primary objective. The objective of the LBO business is maximizing returns for investors."

And it's also why other countries like Denmark, the UK and Germany either don't offer--or are trying to limit--the "public subsidy" that William D. Cohan deemed "the mother's milk of a leveraged buyout". As Felix Salmon noted, the United States could lower the rate at which debt interest can deducted or cap the amount of debt to which it applies. (The Obama administration is considering those kinds of changes in its recently proposed "Framework for Business Tax Reform.") In its January 30, 2012 editorial, the Financial Times lamented:

"The system could be made fairer and more efficient by taxing debt and equity at the same rate...Most of [Romney's] money was made at Bain Capital, which, like all private equity groups, benefits from a federal debt subsidy. It should be eliminated."

Reflecting on his private equity career, Romney in 2007 sounded almost remorseful that the pain from Bain fell mainly on the plain:

"It is one thing that if I had a chance to go back I would be more sensitive to," Mr. Romney said. "It is always a balance. Great care has got to be taken not to take a dividend or a distribution from a company that puts that company at risk." He added that taking a big payment from a company that later failed "would make me sick, sick at heart."

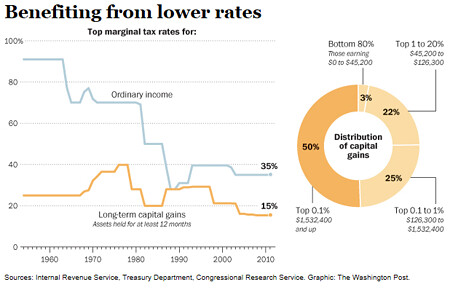

Not so sick at heart, though, to make President Romney change the two key elements of the federal tax code that keep the American private equity gravy train running at full speed. The first is the tax deductibility of corporate debt. The second is the notorious "carried interest exemption" that allows him and fellow fund managers to pay only the 15 percent capital gains rate- and not the 35 percent rate on income- to Uncle Sam. It is that rule that allowed Mitt to pay a lower effective tax rate on his $45 million (much of it still from Bain Capital) over the past two years, a rate below that of many middle class families.

As Alec McGillis noted in the New Republic, even the likes of Stephen Moore and Pete Peterson have grudgingly come to the conclusion that it's time for the carried interest exemption, "which allows fund managers to have their compensation for investing other people's money taxed as capital gains, not earned income," to go. But what makes Congress' largesse to Mitt Romney's ilk so glaring is the historically low capital gains tax rate he and his gilded colleagues now pay.

It's worth noting Bain Capital has come under increasing scrutiny for getting carried away with carried interest. The practice isn't just immoral; in Bain's case, its use of "fee conversion" to evade taxes may also have been illegal:

Private equity funds are usually paid like this: They get a 2 percent management fee, which is taxed as ordinary income at a 35 percent rate, and a 20 percent share at the profits, called carried interest, that's taxed at as capital gains at a 15 percent rate, as University of Colorado law professor Victor Fleischer explains. But since those 2 percent fees can still be a lot of money, funds convert this into carried interest, too, by waiving the management fee in exchange for the chance to skim off the top of future profits. Fleischer writes, "Unlike carried interest, which is unseemly but perfectly legal, Bain's management fee conversions are not legal. If challenged in court, Bain would lose." The New York Times' Nicholas Confessore, Floyd Norris, and Julie Creswell report that the funds converted $1.05 billion in fees that would have been taxed at the higher rate. That saved $200 million in income taxes and $20 million in Medicare taxes.

Leaving that question aside, there's little doubt, as a Washington Post analysis detailed last year, that "capital gains tax rates benefiting wealthy feed [the] growing gap between rich and poor." As the Post explained, for the very richest Americans the successive capital gains tax cuts from Presidents Clinton (from 28 to 20 percent) and Bush (from 20 to 15 percent) have been "better than any Christmas gift":

While it's true that many middle-class Americans own stocks or bonds, they tend to stash them in tax-sheltered retirement accounts, where the capital gains rate does not apply. By contrast, the richest Americans reap huge benefits. Over the past 20 years, more than 80 percent of the capital gains income realized in the United States has gone to 5 percent of the people; about half of all the capital gains have gone to the wealthiest 0.1 percent.

The tax rate on capital gains and dividend income used to be much higher. In the late 1970's, it reach 40 percent. Even as late as 1986 the IRS treated the top taxpayers' investment and earned income the same way. (It is worth noting that lower capital gains tax rates raise income inequality, not investment.) This convenient chart tells the tale:

All of which has--and continues--to work to the great advantage of the one Willard Mitt Romney. To be sure, other codicils of the United States tax code, like overseas tax havens and vagaries of the gift tax have allowed Romney to, among other things, generate a $100 million IRA for his sons, tax-free. (Getting state tax breaks or having the U.S. bail out the pension funds of firms he acquired or even saving Bain & Company itself, didn't hurt, either.) To be sure, Mitt Romney is very smart, very hard working and, to use his words, "extraordinarily successful." But without the policy choices of our elected United States government, Mitt Romney would not have gotten nearly as rich as he did at Bain Capital. As Matt Taibbi put it, "the way Romney most directly owes his success to the government is through the structure of the tax code."

In other words, the government actually incentivizes the kind of leverage-based takeovers that Romney built his fortune on. Romney the businessman built his career on two things that Romney the candidate decries: massive debt and dumb federal giveaways. "I don't know what Romney would be doing but for debt and its tax-advantaged position in the tax code," says a prominent Wall Street lawyer, "but he wouldn't be fabulously wealthy."

Not without you, that is. After all, you built Bain Capital.

(An earlier version of this piece appeared at Perrspectives.)